(This is a story we first wrote for NBC News)

Ever check out of a hotel and notice a “transient occupancy tax” on your bill?

Unfortunately for your wallet, the Biden administration’s crackdown on “junk fees” won’t do anything about it.

But unlike some of the add-ons hoteliers and booking sites charge, this common type of tax doesn’t pad corporate margins, and the projects it funds are evolving in step with the post-pandemic tourist economy.

These levies — often known generically as “bed taxes,” though they go by many names — are imposed by state, county and local governments or tourism improvement districts.

They can drive up the cost of an overnight stay at hotels, motels, bed and breakfasts, campgrounds, and short-term rentals like Airbnbs, sometimes by up to 20%.

The jurisdictions typically decide how to allocate the revenue these taxes pull in. Sometimes they supplement governments’ operating budgets; other times they’re used to finance tourism campaigns, build convention centers, support cultural programs, or hire beach lifeguards.

New Uses For Hotel Bed Taxes

But in Estes Park, Colorado, bed taxes are now subsidizing housing and childcare costs for local workers.

The mountain community, known as a base camp for adventures in Rocky Mountain National Park, voted for that move after a law Colorado enacted in March 2022 began allowing cities and counties to use hotel tax proceeds to cover housing and child care for the tourism-related workforce

In Estes Park, the decision came after advocates flagged a proliferation of second homes and short-term rentals that they said had strained affordability in the area.

Last November, the city raised its hotel bed tax to 5.5%, up from 2%, and earmarked funds from the increase — an estimated $5.3 million in 2023 — for the housing and child care initiatives, said Kara Franker, the CEO of Visit Estes Park, a local tourism group. That beefed-up bed tax now combines with town, county and state sales tax to add a cumulative 14.2% onto the cost of a nightly stay in the city, she said, helping to fund a range of public services alongside the new workforce-related initiatives.

According to Colorado tourism officials, at least 17 municipalities have imposed a new bed tax or modified an existing one over the past year, many of them putting the revenue toward new types of projects.

Similar moves are happening in tourism-heavy areas across the U.S., said John Lambeth, CEO of travel consultancy Civitas, reflecting a more expansive approach that is “more about stewardship of the destination and giving back to the community.”

Jack Johnson, chief advocacy officer for the travel industry group Destinations International, said the disruptions of the pandemic have motivated some communities to consider whether broader social and economic policies “can be tied to travel in tourism, either directly or indirectly, and therefore paid for out of the bed tax.”

Hotel taxes were first adopted in the U.S. by New York City in 1946, became commonplace nationally by the 1970s, and are what guests typically see itemized on their hotel bills today, said Elizabeth Strom, an associate professor at the University of South Florida’s school of public affairs. Public officials have long loved bed taxes because they generate easy-to-raise income from out-of-towners, not local voters.

“Every state either has such a tax at the state level or permits such a tax at the local level or both,” Strom said.

The newer breed of bed tax experiments, like those in Colorado, are being driven as much by windfalls from rebounding travel demand as by evolving civic attitudes.

Tourism revenues dipped sharply during the pandemic, but in 2023, hotel-generated state and local tax revenue — which includes bed taxes along with the other levies lodging operators contribute to government entities — is expected to reach $46.71 billion nationwide, up 13.6% from 2019, according to a study by the American Hotel and Lodging Association and Oxford Economics.

Bed taxes already account for nearly half of the hotel-generated taxes in the U.S., the AHLA said, and it expects bed taxes this year will likely exceed the $19 billion they generated in 2019.

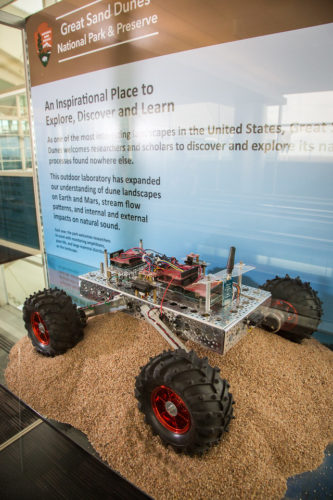

In Florida, which has been hit by multiple hurricanes that affect beaches and islands, Broward, Collier, Lee and other counties are applying tourism revenues to rebuild and protect those travel assets, Johnson said. Bed taxes now contribute financing for dune restoration, shoreline stabilization, erosion control, and other coastal management activities, he said.

The shift has raised some concerns from the hospitality industry.

“In general, the more taxes states and cities levy on hotels, the more of a competitive disadvantage they create for local businesses, as potential hotel guests may seek out other destinations with lower tax burdens,” AHLA CEO Chip Rogers said.

As for the industry-imposed fees the Biden administration is scrutinizing, AHLA spokesperson Curt Cashour said that only 6% of hotels nationwide charge “a mandatory resort, destination or amenity fee, at an average of $26 per night,” adding that they “directly support hotel operations” like staff wages and benefits.

Cashour said the AHLA is continuing to work with authorities “to ensure that the same standards for fee display apply across the lodging booking ecosystem” so guests aren’t caught off guard.

Bed taxes may send extremely cost-conscious leisure and business travelers to lower-taxed destinations, Strom said, “but if you are a unique location, I don’t think an extra few dollars a night in taxes matters.”

“If people want to see the Space Needle,” she added, “they aren’t comparing the cost of rooms in Seattle to the cost of rooms in Portland.”

Some top tourist destinations say they aren’t worried about turning away tourists at the moment.

Hawaii, for example, is seeing a strong post-pandemic tourism recovery, even though its 13.3% state and county transient accommodation taxes combine with 4.5% excise taxes to add close to 18% to nightly hotel bills. State revenue forecasters expect Hawaii’s bed tax alone to bring in more than $785 million this year, up from $645 million last year.

Since drawing more tourists isn’t the main challenge, said Ilihia Gionson, a public affairs officer with the Hawaii Tourism Authority, the agency is using some of the funds it gets from hotel taxes to try to influence what types of visitors it attracts.

“The wheels were turning before the pandemic and accelerated during the pandemic,” he said. “We want visitors that align with our economic and community goals — who will shop at local businesses, eat in local restaurants, participate in ‘voluntourism’ and be mindful of their economic impact. So, it’s less about, ‘Come here,’ and more about, ‘Here’s who we are and what we’re about.’”

Keys for Trees

San Luis Obispo, along California’s Central Coast, is also earmarking some of its hotel tax income for projects that authorities hope will benefit the community.

Its existing transient occupancy tax supports the city’s general fund. But last year a new “Keys for Trees” program began setting aside some proceeds from the city’s tourism assessment tax — another government surcharge on hotel bills — to help plant 10,000 trees by 2035 as San Luis Obispo pursues its carbon neutral goals, said Tourism Manager Molly Cano.

The city’s business improvement district raised $1.6 million from this assessment pre-pandemic and $2.1 million in fiscal 2022, Cano said. Previously, all these funds were used to market San Luis Obispo to visitors. But now 1% of that revenue is steered toward the new program, with some $17,000 reserved for planting 35 trees this fiscal year.

“There’s no extra step to take,” Cano said, “and we think visitors will enjoy knowing that just by booking an overnight stay, they are helping to preserve the beauty of our community.”